In Yoplait’s, it was the arrival of Chobani Greek yogurt, which has more protein and a thick, creamy texture that struck a chord with consumers. In Gerber’s case, it was the growing popularity of small organic baby-food brands. Both led their respective categories, but their market shares tumbled in recent years. Nestle SA’s Gerber baby food division and General Mills Inc’s Yoplait yogurt business may each offer a cautionary tale for Kraft.

/cdn.vox-cdn.com/uploads/chorus_image/image/69575045/VL_x_Kraft_Overscooped_Pint_PMS_Color.0.png)

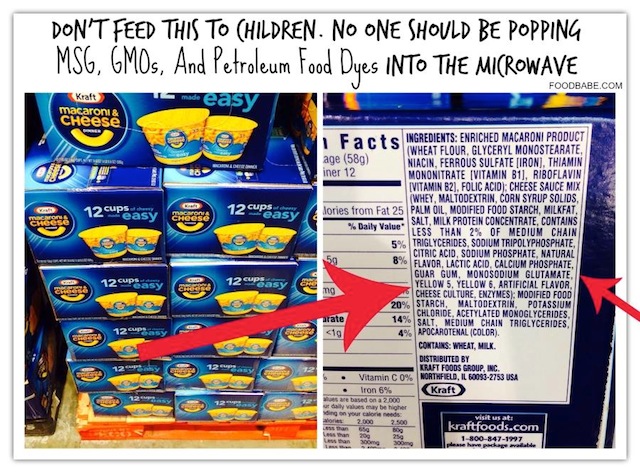

“Even though individual companies by size are quite small, in aggregate they’re more on trend with consumer demand and pose a threat to Big Food over time,” said Consumer Edge Research analyst Robert Dickerson. The challengers are more nimble upstarts catering to rapidly evolving consumer tastes by offering products in the fast-growing “health and wellness” category. On one side stand established food companies like Kraft, which seem more focused on slashing costs than taking big risks on emerging trends. Kraft Foods Group Inc still dominates the category, but the battle for the hearts and minds of American mac-and-cheese lovers may become a new front in a running war in the $360 billion U.S. Sales of macaroni and cheese are growing as busy Americans look for convenient and inexpensive meal options and older consumers indulge in the comfort foods of their youth. “But the ability to make it just a little bit better, and the color that I can believe comes somewhat naturally is good.” “I’m fully aware that it is not a health food,” said Godschalk, of Annie’s macaroni and cheese product. Now she buys Annie’s organic version in bulk at Costco Wholesale Corp. Zenobia Godschalk, an Atlanta mother of two young boys, stopped buying Kraft’s “mac and cheese” after reading its complicated ingredient list. LOS ANGELES, March 30 (Reuters) - Kraft Macaroni & Cheese has been a favorite meal for generations of American children, but smaller brands made with more natural ingredients are starting to nibble at its market share, part of a trend that is biting into growth at large U.S.

0 kommentar(er)

0 kommentar(er)